Will the Subsea industry move away from oil and gas?

Outside and inside pressure on the oil and gas industry have actually exacerbated relationships with the subsea industry, those in charge of supplying vital equipment for oil and gas projects. With brand-new possibilities for subsea firms beyond their conventional financial investments, we take into consideration the future of the partnership between the oil and gas and subsea industries.

Setting a limit: could the subsea sector move away from oil and gas? The outcome of these broken partnerships might be that the subsea sector distances its self from oil and gas, at the very least to a small degree. Source: Technip FMC Technologies share article: (paraphrasing)

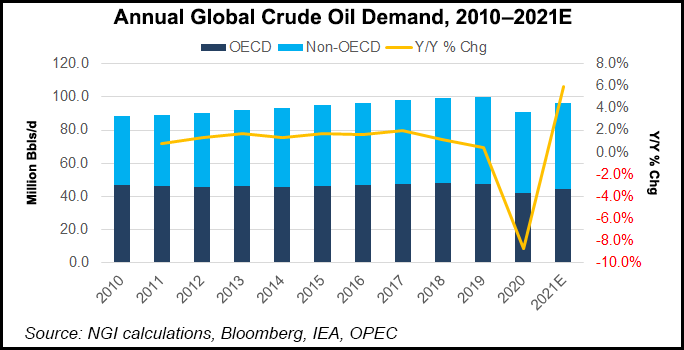

At a glance, the worldwide oil and gas industry might be thought of as healthy, at the very least from a production perspective. Worldwide crude oil output has actually lept from over 3 billion tons in 1990 to 4 billion tons in 2011, and also has actually not dropped below this standard since need for oil has actually never been greater, particularly in nations such as China, which saw oil needs rise by 36,000 barrels daily in 2016 alone, the daily standard usage of the Philippines, and this is a pattern that is braced to carry on.

There is likewise an environmental debate to the ongoing increased need for gas, with several nations changing from coal-powered processes to gas as a result of the fairly restricted environmental impact. Consequently onlookers such as SP Global and the International Energy Association have actually called this era the “golden age of gas,” without any indication of a downturn in worldwide need or production.

Yet these two sectors will encounter a considerable difficulty, and one from within their own industries. The subsea sector stood for by firms that create equipment and frameworks that allows a lot of these oil and gas operations to work, is being significantly delayed by what some think to be an excessively demanding oil and gas industry, one that is promoting higher production at a reduced price, to such a degree that it maybe considered to be economically illogical.

Undoubtedly, as the globe moves towards a greener energy mix, there are lots of brand-new possibilities for the subsea industry. The National Subsea Research Institute discovered that offshore wind output is anticipated to get to around $276 billion, while food from the globe’s seas might be worth an extra $1 trillion, two emerging sectors that the subsea industry has the experience as well as proficiency to make a dent in, and increasing the possibility of the subsea and oil and gas industries drifting apart in years to come.

Inner tension and outside pressure behind this issue among the subsea sector is the difficulties that have actually faced the oil and gas industry much more generally, and threaten the wider strokes of progression made over the couple of decades. The 2014 oil price fall, which saw the cost of Brent crude collapse from $115 a barrel in June 2014 to $49 a barrel not only rocked worldwide oil and gas markets, but urged brand-new development in the industry such as fracking, both of which endanger the existing partnership between oil and gas and the subsea industry.

“With the reduced number of subsea Christmas tree orders, an essential measure of the wellness of the market, it’s obvious that 2020 will certainly be among the worst in years gone by,”(paraphrasing) stated Neil Gordon, chief executive of Subsea UK.

These “Christmas trees”, frameworks consisting of valves and pipes that allow operators to analyse, maintain, and control the circulation of generated oil, are an essential component of the subsea industry and a decline in sales is worrying, at the very least in the here and now.

“Nevertheless, indicators from Rystad indicate a rise in Christmas tree demand in 2021 and towards reasonably fast recovery towards the end of next year,” (paraphrasing) stated Gordon. “However there will certainly be the unavoidable lag as jobs come through, resulting in a sub-contracting of the supply chain. A damaged supply chain is the largest, and possibly most long-term danger we will encounter.”

This danger to the oil and gas supply chain might be seen as an internal one, inasmuch as it includes well-known pros in the oil and gas industry, and the partnerships and deals between them. Nevertheless, Gordon noted that outside pressure, such as Covid-19 has actually added an extra collection of difficulties for the industry.

Having actually only just begun to recover from one of the most drawn-out declines, Covid-19 and also the subsequent fall of oil and gas prices showed a double blow for subsea firms,” he stated. “With potential customers running out nearly overnight, chance and exposure have just about vanished. (Paraphrasing)

“This combined with the unpredictability around exactly how to run under the restrictions, has been among the greatest difficulties for firms. The uncertainty around running working in a worldwide pandemic will certainly reduce as firms are overcoming the preliminary shock and discovering exactly how ideally to handle their operations within the new norm.” (Paraphrasing)

These unforeseen challenges have actually weakened the partnership between oil and gas players and the subsea industry, presenting additional instability and unpredictability to the industry. Gordon noted that the firms, in both sectors, that better adjust their operations and communicative processes will certainly come out better off.

“Those subsea firms that have had the ability to verbalize just how they include value and show exactly how they can function co-operatively to maximise efficiencies with long-lasting financial savings are best placed to see this out, “ he stated. “There have actually been instances of best practice where consumers and providers have actually functioned jointly on driving efficiencies and considering value instead of price, and also understanding of the demand to safeguard margins to make sure certain providers stay in business.” (Paraphrasing)

However, he likewise stated that there had actually been some vicious cost-cutting and some bad practices in exactly how this is communicated, “indicating that some players in the industry have barley coped to adjust to this swiftly changing industry. Stuart Payne, supply chain director at the UK’s Oil and Gas Authority, the government body tasked with controlling the industry declared that some oil and gas firms had actually required providers reduce prices by as much as 40% over night, a step which would certainly have made a lot these providers’ companies economically illogical.

The outcome of these broken partnerships might be that the subsea industry distances itself from oil and gas at least to a tiny degree, and at least in the long-term.

“While oil and gas is still the biggest market for the subsea industry, diversity into various other areas of subsea engineering is vital than ever before,” stated Gordon. “Offshore renewables currently make up nearly 25% of all subsea profits.

The subsea industry basically consists of all things below the water line and represents a huge possibility from offshore wind to hydrogen and also CCUS carbon capture, use, and storage, military defence, marine scientific research, and aquaculture farming.” (Paraphrasing)

The clean energy shift. This wish to branch out likewise shows the subsea industry’s expanding role in a clean energy transition, as they are among numerous players’ anxious to reduce their environmental impacts. Gordon noted, however that this shift would certainly be most practical if it was accomplished slowly.

“The energy shift is what it really claims, a ‘shift’ which indicates it is a period of adjustment from one state to another,” he described. “A solid oil and gas industry is consequently most likely to sustain the environment-friendly healing and this requires a variety of campaigns to promote activity around projects in the short-term that will produce supply chain demand as well as opportunity.

“The industry does not need charity, it intends to trade its way out of this slump.” (Paraphrasing)

This concept of lining up environmental sustainability with financial gain can prove to be an essential part of the future of subsea industry. Gordon noted that removing food, instead of oil, from the globe’s seas, could be a possible opportunity for the subsea industry, as it aims to preserve its bottom line while expanding its activities.

“With a growing quantity of our food and power originating from our seas, this ‘blue economy’ estimated to be worth $1 trillion represents considerable possibilities for financial investment with significant and lasting returns,” he described. “We must work together in a delicate way to handle this resource financially and sensibly, guaranteeing the future sustainability of our seas.” (Paraphrasing)

In the same token, Orsted has actually long been showcased as the shining example to follow of an oil and gas firm embracing clean energy, and much more recent evaluation has actually indicated that the renewable energy market will be both environmentally sound, and extremely lucrative, for the industry. At the Subsea Exposition hosted in Aberdeen in February, Wood Mackenzie expert Mhairidh Evansnoted that Subsea financial investment in offshore wind might double over the following 5 years, with much of the yearly $49.2 billion financial investment in the industry originating from Europe.

New technical difficulties in the offshore wind field more generally might additionally provide possibilities for the subsea industry, which boasts leading experience and framework to get over these obstacles. Numbers from GlobalData reveal that offshore wind sites farms are being set up at reduced depths from a typical depth of 30 meters below the surface in 2018 to 33 meters annually later on showing new technical and logistics issues for the offshore clean energy industry.

Nevertheless, the oil and gas industry looks readied to stay the subsea industry’s largest partner, at the very least in the foreseeable future, as the subsea industry supplies this steady clean energy shift.